Custom Automotive software for you

With Jericho’s omni channel platform there is no such thing as too much information.

Jericho provides the only solution in the indirect auto lending business that provides daily management of multiple modules on a single platform. Data from many legacy systems is imported to support Analytics. CRM. Risk, Compliance, Dealer Management and much more providing a high ROI.

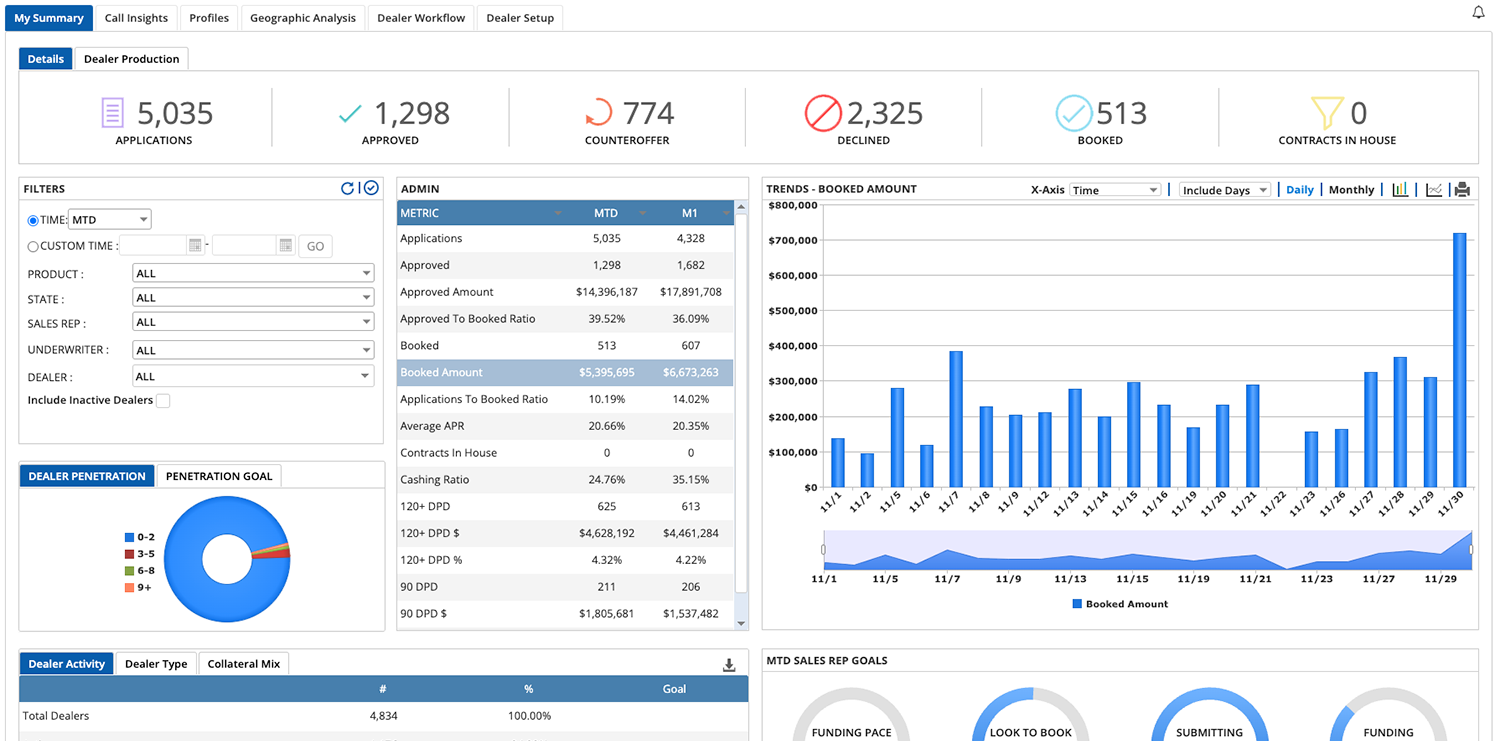

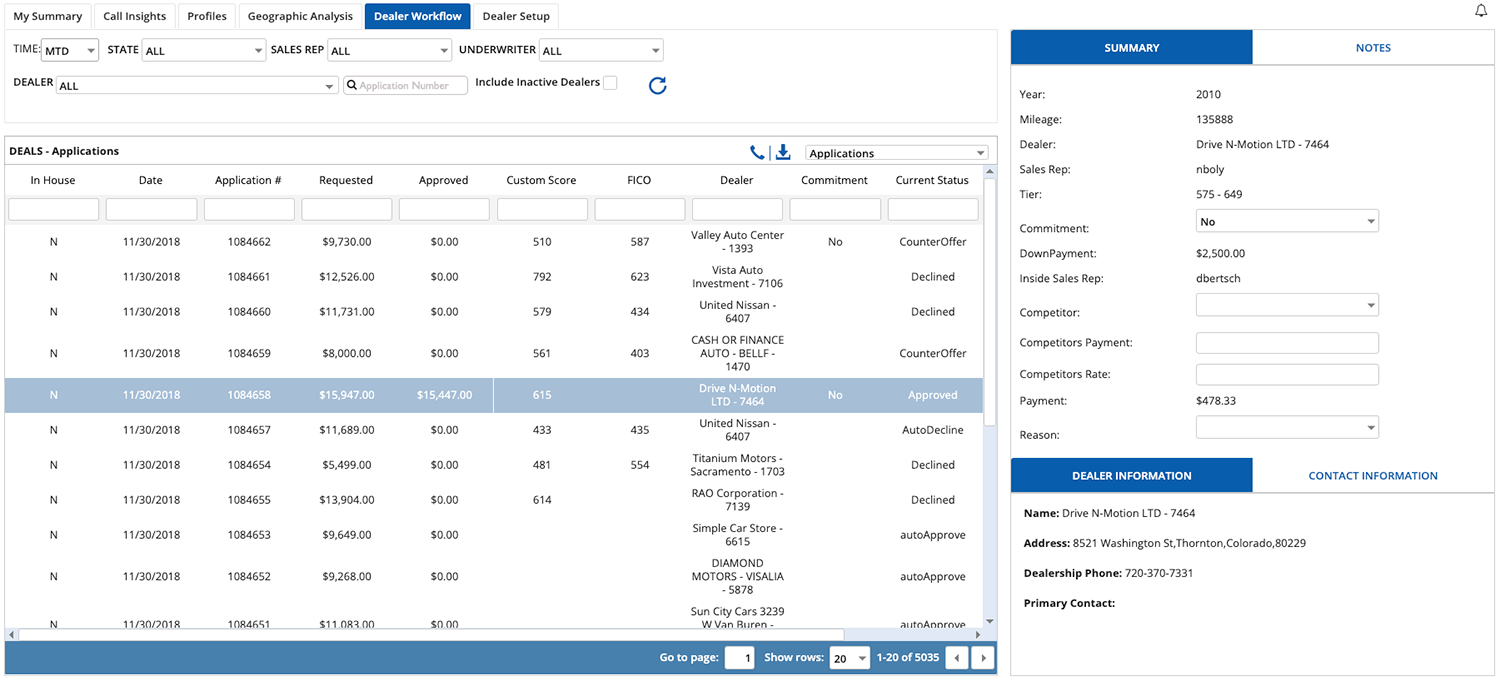

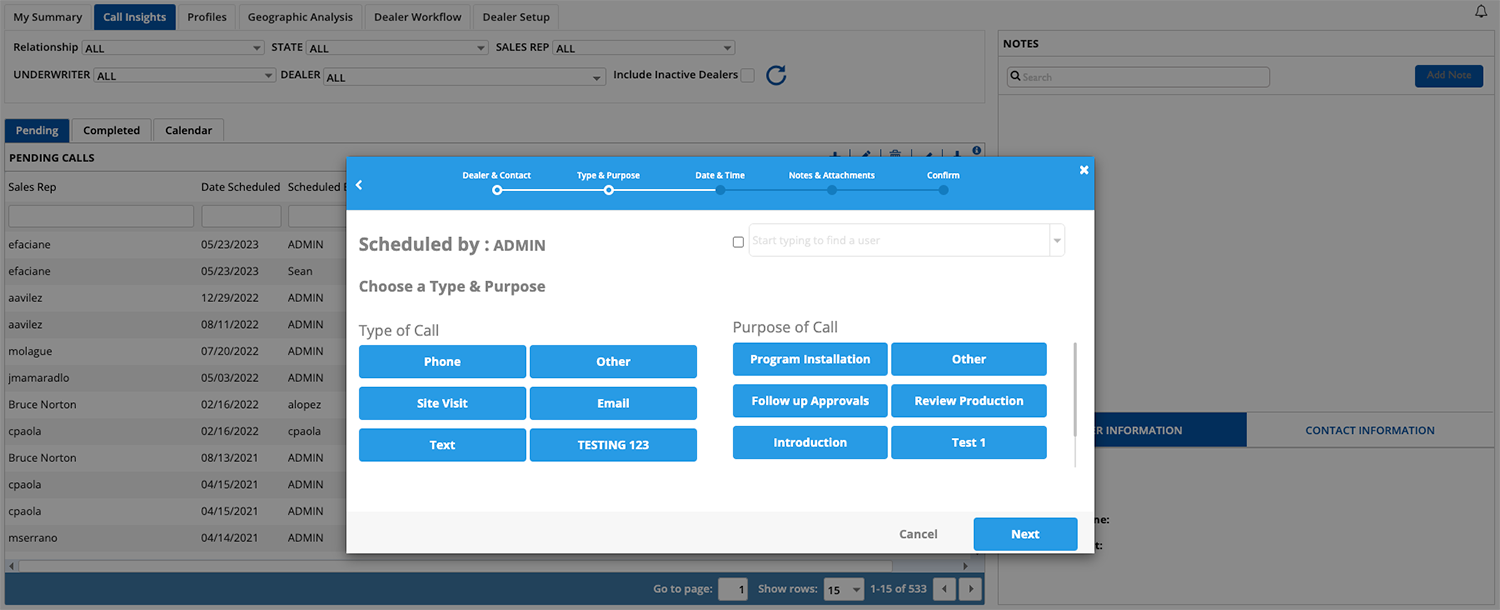

A CRM that combines calling activity with production and performance data, allowing users to maximize relationships, create marketing strategies and improve profitability. Dealer relationships never faulter when reps can plan, scehdule, and track call their insights.

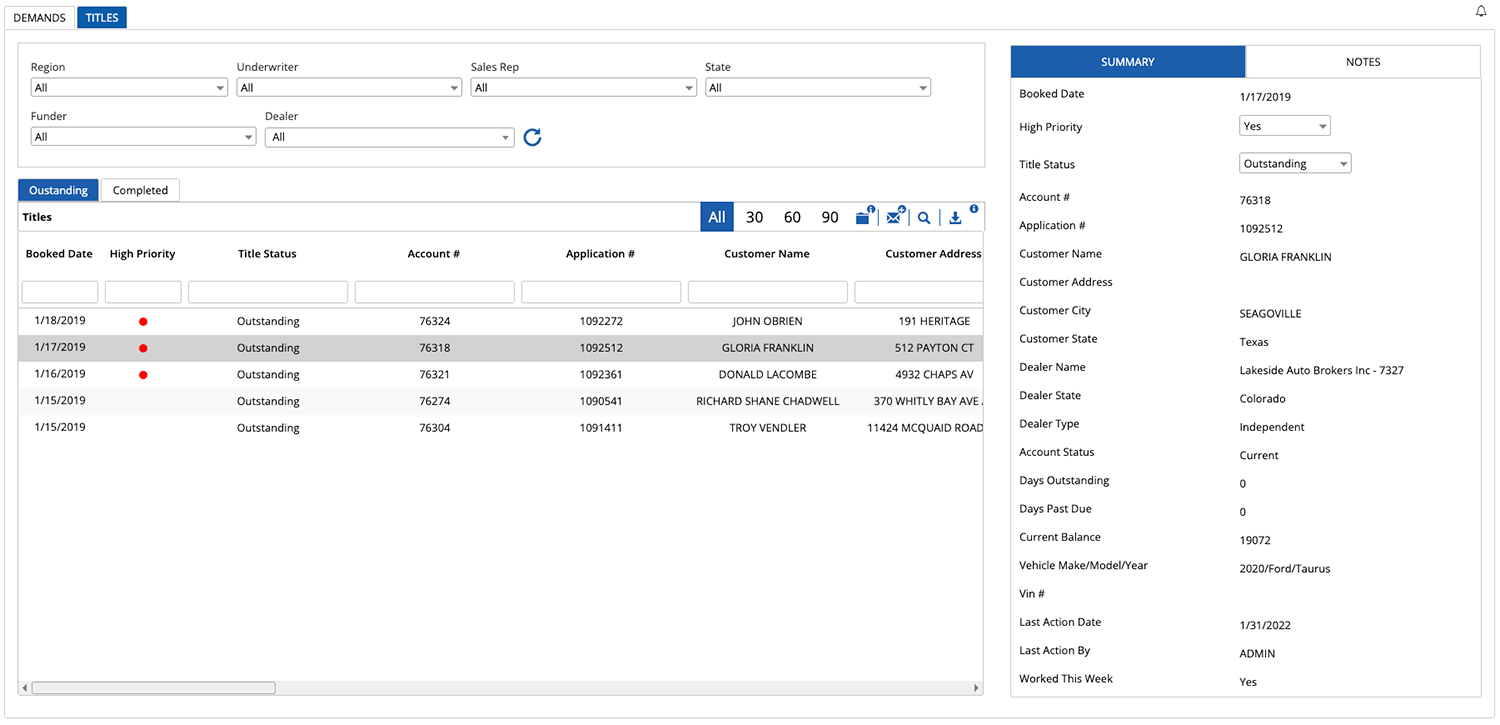

Create, issue, and send out demands when dealers and customers need to be held accountable. Assign dollar amounts, issue follow-ups with automatic reminders, email notifications, and alerts to upper management if items are not resolived on time.

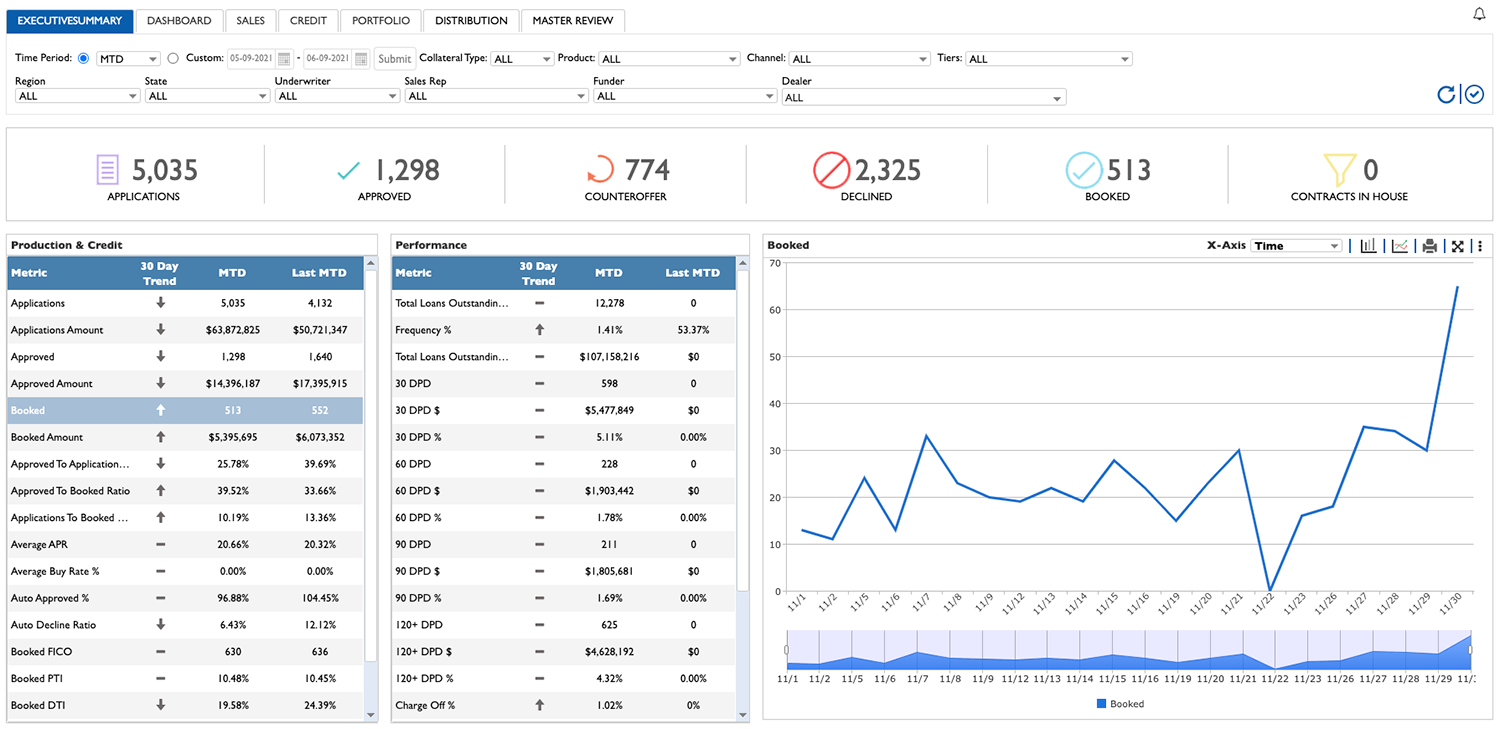

Your Executive Summary uses multiple filters allowing you to slice and dice all of your Loan Origination, Servicing, Commercial, General Ledger, Title, Rebate and Collections metrics - our single platform provides accurate REAL TIME data to every level of your enterprise.

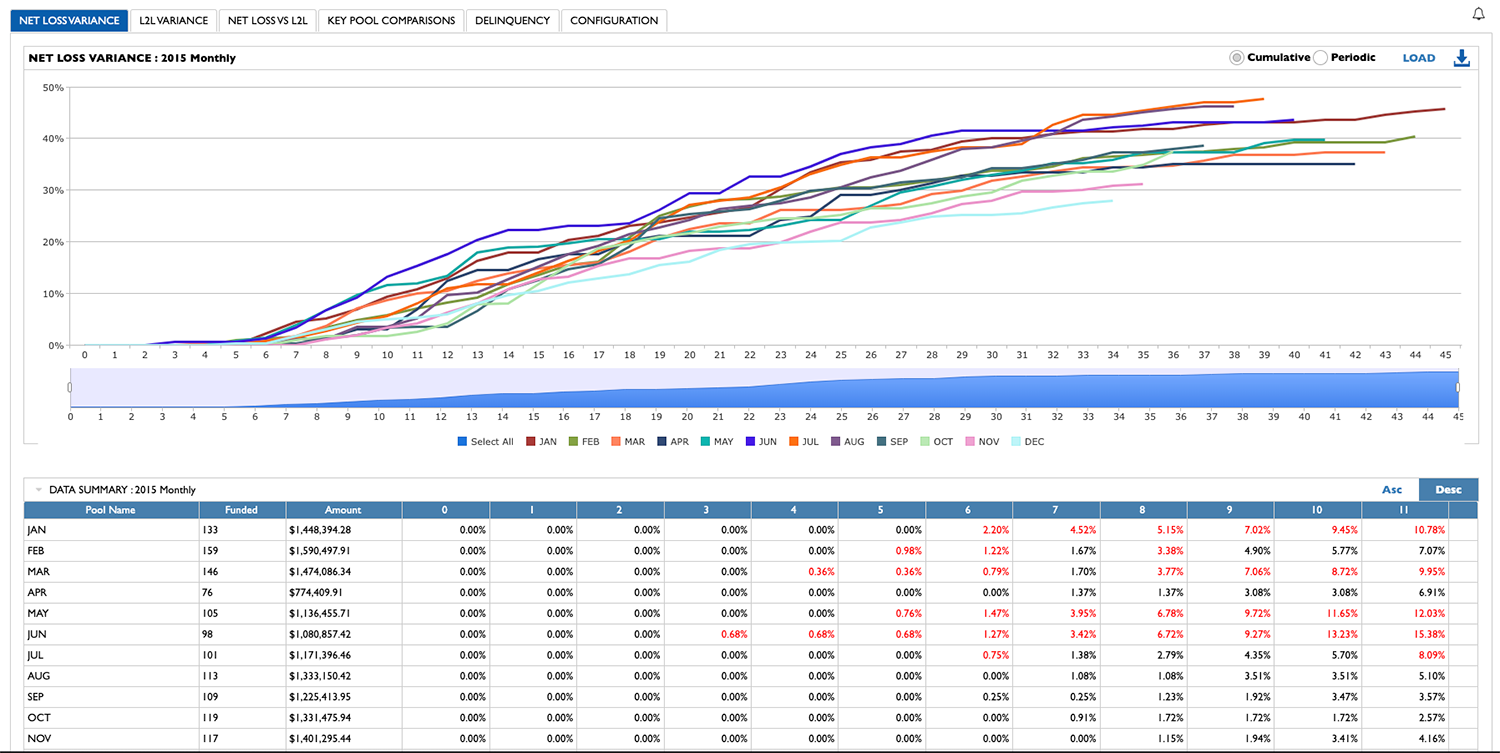

Create loss curves in minutes, not hours. Analyze results in real time to quickly identify pain points with Loss Analysis, Key Pool Comparisons, L2L Variance and Deliquency Trends.

With your own customer and dealer information loaded, easily enter, assign and track complaints for follow-up and resolution before complaints can excalate into larger issues.

Designed and implemented by compliance experts using the most recent CFPB requirements as the benchmark. Know that your policies and procedures are always up to date with notifications and reminders.

Incorporated with the most powerful and up-to-date set of Competitive data - Jericho's CRM gives the power back to the rep. Combining:

For over sixteen years Jericho has been helping clients extract data from legacy systems for use in the Jericho platform. This has been accomplished with the majority of the LOS and LMS applications in use today. We work closely with our clients on data mapping, metric definitions, and data reconciliation to create the most accurate results for each user.

Each implementation starts with the discovery phase to build a strong foundation for the client. Systems are identified, data is reviewed, and custom project plans are provided.

Jericho will complete all the data mapping and set up the platform in your local environment or at the Jericho Cloud in MS Azure based on your needs.

Detailed data reconciliation is conducted with Jericho and the client. This includes at the import time, metric calculations, & UI displays at many different levels. Training is provided by our SMEs for every module in the Jericho platform before production.

Highly intuitive dashboards for every aspect of your organization - all communicating together.